Navigating the world of loans can frequently feel like roaming via a complex labyrinth, where each turn presents new difficulties and decisions. From the heart of the maze lies a crucial factor that can significantly impact the financial future: attention rates. Understanding exactly what interest rates are and precisely how they influence the loan can encourage you to definitely make informed choices, whether you're looking for a mortgage, a personal loan, or financing for any automobile.

Fascination rates can become perplexing, especially regarding beginners. They change based on a variety of factors, including typically the type of loan, typically the lender's policies, plus the prevailing financial conditions. On this page, we all will unravel typically the secrets behind interest loan rates, exploring essential topics such as fixed versus variable rates, the part of credit ratings, and exactly how the Federal government Reserve's decisions form the lending surroundings. By equipping yourself using this knowledge, a person will be far better prepared to risk-free the best terms plus navigate the financial loan labyrinth with confidence.

Understanding Interest Rates

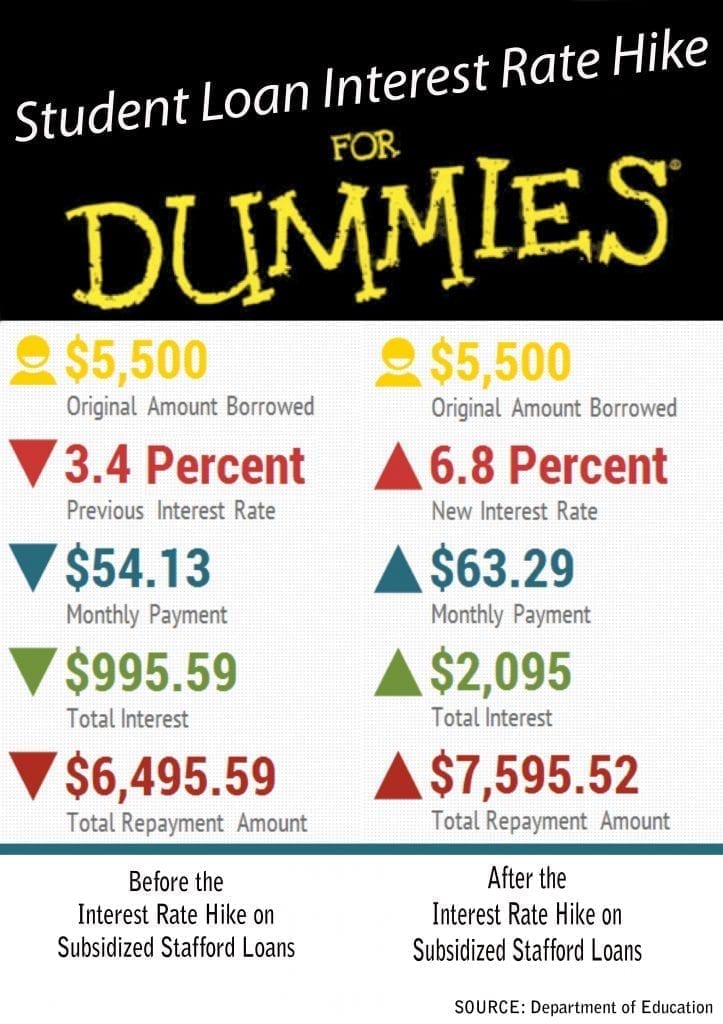

Interest rates are a crucial aspect of borrowing and even lending, influencing the expense of loans and the particular outcomes for borrowers. In its core, a good interest rate represents the cost involving borrowing money, stated as a percentage of the principal amount over a new specified period. This rate can substantially impact the quantity of which borrowers will pay off over the existence of a mortgage. Understanding how interest rates work is fundamental for making well informed decisions when contemplating loans for residences, cars, personal demands, or education.

The effects of interest costs can be seen in many features from the economy plus individual financial situations. Higher interest rates can lead to be able to increased monthly obligations and greater total costs, which makes it vital for borrowers to judge their options thoroughly. Conversely, lower interest levels can provide possibilities for people to help save money over typically the duration of their loan products. It is crucial to understand the dynamics involving interest rates to be able to navigate the intricate landscape of financial loans, ensuring that selections align with monetary goals.

Furthermore, the determination appealing rates is usually influenced by several factors, including loan provider policies, market factors, and government regulations. The interplay in between these elements creates some sort of shifting landscape that will can challenge borrowers as they seek the best possible terms regarding their loans. Simply by understanding interest rates, men and women can equip by themselves with the understanding needed to discover favorable borrowing options while avoiding stumbling blocks that can lead to be able to increased financial troubles.

Deciding on the Right Loan Price

Choosing the right loan level is important for equally short-term and long-term financial health. Whenever navigating Great site , it's important in order to assess if the set or variable attention rate aligns better with your individual financial situation and even future plans. Predetermined rates provide balance and predictability, generating budgeting more workable, while variable prices may offer reduced initial costs although come with the risk of fluctuating payments that can easily escalate over time. Consider your risk tolerance and how long you intend to hold the particular loan to make an informed selection.

Learning the broader economic symptoms that impact interest rates can greatly impact your decision. Federal government Reserve policies, pumpiing rates, and international economic events may cause shifts inside loan interest rates. Keeping informed regarding these trends allows you in order to time your bank loan applications more intentionally. For instance, in the course of periods of economic growth, rates may possibly rise, making it beneficial to secure some sort of loan at some point.

Lastly, in no way underestimate the importance of your credit score if choosing financing rate. Lenders use credit score scores as the benchmark to measure risk, and a higher score generally results in more favorable interest terms. If the credit profile isn't ideal, take methods elevate it before using for loans. Simply by combining a knowledge associated with your personal monetary goals, the current economic landscape, plus the impact involving your credit, you are able to successfully choose a loan rate that fits your unique needs.

Strategies for Obtaining Lower Rates

One powerful technique for securing lower interest levels on loans is to improve your own credit score prior to applying. Lenders work with credit scores to be able to gauge the risk of lending to you personally, and a larger score typically explicates to lower rates. Start by examining your credit record for errors plus ensuring all repayments are made in time. Lowering your credit rating utilization and addressing outstanding debts can also provide some sort of boost to your own score, making you more attractive to lenders.

An additional way to acquire favorable rates is always to shop around and compare offers from multiple lenders. Every single lender has its own criteria regarding determining rates and costs, so it's important to gather quotes by banks, credit unions, and online lenders. Don't hesitate to negotiate with loan companies, as they might be willing to match or beat competitor offers to secure the business. Always read the fine print and consider the total cost associated with borrowing, not just the interest rate.

Lastly, think about the benefits of making a larger down payment or deciding on a shorter loan term. A higher off payment can reduce typically the amount you will need to borrow, which usually can lead in order to lower interest costs. Additionally, Go to this website come with reduced rates as they cause less risk in order to lenders. As a person explore your alternatives, preserving these strategies in mind can prospect to significant financial savings on your financial loan overall.